The Future of Trading: Embracing CFDs in Your Investment Journey

If you are looking for an effective way to increase your profits and grow your investment portfolio, then Cfd trading is something that you should consider. CFDs, or contracts for difference, are derivatives that enable traders to speculate on the rising or falling prices of a wide range of financial instruments, such as shares, indices, commodities, and Forex. Cfd trading can be highly lucrative, but also comes with inherent risks that must be taken into account before investing. In this article, we will explore the basics of Cfd trading, so that you can assess whether it is a worthwhile option for your investment strategy.

Understanding Cfd trading

Cfd trading involves the buying or selling of a contract that reflects the underlying asset’s price movement. When trading with CFDs, traders do not actually own the asset itself, but can still profit from either its rise or fall in price. cfd trading also allows traders to leverage their trade positions and only have to invest a small percentage of the full position amount, known as margin trading. This can be a good way to increase your potential profits, but also magnifies losses if the trade goes against you, so it is essential to manage your risk effectively.

How to Trade CFDs

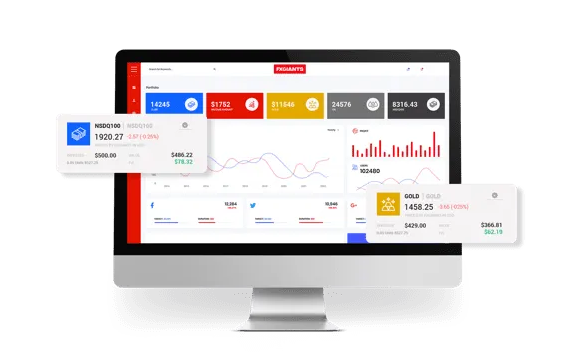

Cfd trading can be conducted through a broker, who acts as the intermediary between you and the underlying asset. Each Cfd trading platform will offer an array of markets that you can trade on, including stocks, indices, currency pairs, and commodities, among others. To start trading, you will need to deposit funds into your trading account and choose which financial instrument you wish to trade. Once you have made the decision, you will need to determine your contract size, or the amount of money you wish to trade in each unit of the underlying asset.

Risk Management Strategies

As with any investment, Cfd trading comes with risks that must be taken into account. The use of leverage means that profits can be amplified, but losses can be magnified too. As a result, it is critical to have a sound risk management strategy in place to protect your capital. Options available include stop-loss orders, which allow you to set a maximum loss limit for each trade, and limit orders, which can be used to ensure your trade only executes at your desired sell or buy price, preventing unfavourable price changes. Other ways to manage risk and improve your profits include diversifying your portfolio, using technical indicators, and staying up to date with market news and trends.

short:

In short, Cfd trading is a great way to diversify your investments and potentially earn substantial profits. However, like any investment opportunity, there are inherent risks that you should be aware of, and it is critical that you have a sound risk management strategy in place to protect your capital. With the right approach, you can enhance the potential gains of your portfolio, so it is worth considering Cfd trading as an option. If you are interested in Cfd trading, we recommend that you do further research and practice on demo accounts before plunging into real-money trades. Good luck!